Personal planning for people living with dementia and caregivers in BC

If you are living with dementia, it can become difficult to make choices about your care, finances and other crucial decisions as your dementia progresses. However, there are a number of things you can take action now to ensure your wishes are communicated, heard and respected.

Making plans ahead of time for health-care, legal and financial planning is important for everyone. If you are living with dementia, it can become difficult to make choices about your care, finances and other crucial decisions as your dementia progresses. However, there are a number of things you can take action now to ensure your wishes are communicated, heard and respected.

The information on this page is a brief overview to help families get started on the personal planning process in BC and the Yukon and does not take the place of advice from qualified legal and financial professionals. Please consult legal and financial professionals for details.

What is personal planning?

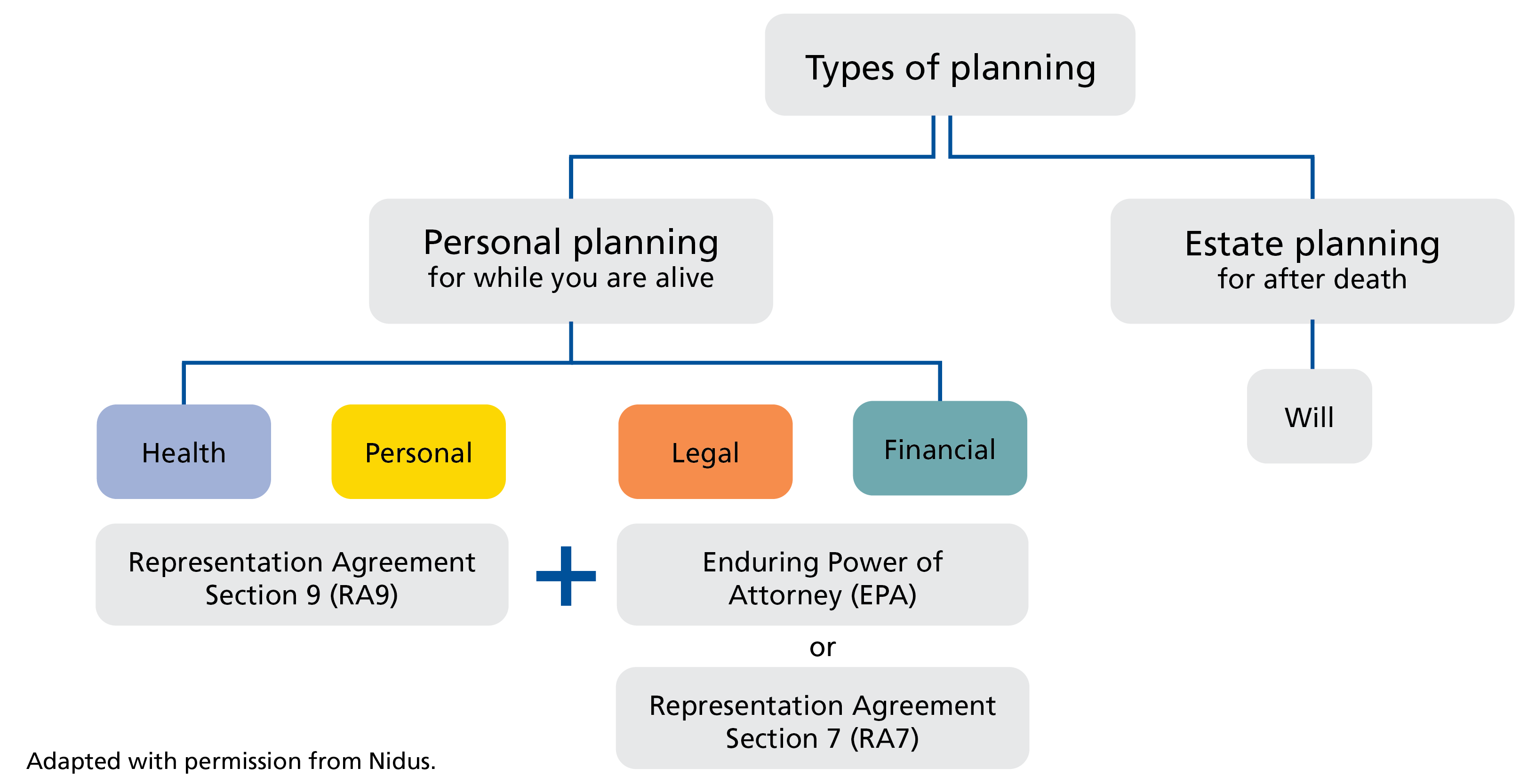

Personal planning is different from estate planning, which is what many of us might immediately think of, when we think about planning for the future.

- Estate planning is for what will happen to your assets after you die.

- Personal planning is for what happens to and for you during your lifetime.

Personal planning can be challenging, as it requires us to talk about uncomfortable issues that we’d rather not even think about. However, if we start these difficult conversations now, we will have less distress in the future.

We encourage planning as early as possible to make it easier for the person living with dementia to be part of the conversation, allowing care partners and family members to feel more confident in honouring and implementing their wishes.

Planning is a process. For many, getting started can feel overwhelming and may lead to procrastination. Learning more about what planning is required for your situation and what resources available can help with these feelings and make the experience more manageable.

In British Columbia, there are two different personal planning paths:

- Planning for the future is for people who have legal competence, meaning they are able to understand and appreciate the nature and consequences of their planning decisions at the time that they are making those decisions.

- Planning for help today is for people later in the dementia journey, whose capability is already under question.

Path one: Planning for the future

This path is for adults who are legally capable of understanding the impact and consequences of their planning documents at the time they are making those decisions.

Example: Greta is a 45-year-old caregiver to her father. She has no cognitive difficulties and is fully capable of making her own decisions, so Greta would be on this path.

If you are on this path, there are two legal documents which cover all life areas: an Enduring Power of Attorney (EPA) and a Representation Agreement, Section 9 (RA9).

Enduring Power of Attorney (EPA)

The Enduring Power of Attorney is a legal document that allows you to give legal authority to a trusted person or persons to manage your legal and financial affairs and make decisions on your behalf, even if you become legally incapable (that is the “enduring” part). It does not cover health-care or personal care decisions; here In B.C., you need a Representation Agreement (see next section) to authorize someone to make those kinds of decisions on your behalf.

When a person is diagnosed with dementia, an Enduring Power of Attorney may be important, especially if major assets like homes or cars are owned jointly. The law in B.C. requires that both owners of an asset be able to sign any documentation about the assets. Because dementia is a progressive disease, there will come a time when the person living with dementia will not be legally capable of giving informed consent. Having an Enduring Power of Attorney in place can help ensure that your wishes are carried out.

We strongly recommend consulting a lawyer or notary public about an Enduring Power of Attorney. Additionally, they can assess the legal competence of the person with dementia, which is a requirement for creating an Enduring Power of Attorney. Legal competence refers to the mental capability to independently make decisions.

More information about creating an Enduring Power of Attorney can be found on the Nidus web page.

Representation Agreement Section 9 (RA9)

The second document for future planning is a Representation Agreement. This legal planning document allows you to give someone you trust the legal authority to make health-care and personal care decisions on your behalf if you become unable to make those decisions for yourself.

In British Columbia, two different representation agreements are available: Representation Agreement, Section 9 (RA9) and Representation Agreement Section 7 (RA7) which will be explained in the next section.

The Representation Agreement, Section 9 (RA9) is for people who are planning for the future. The RA9 requires that the person understand the nature of what is covered in the legal planning document and the consequences of authorizing someone to act on their behalf for health and personal care.

While the RA9 doesn’t require a lawyer or notary to create, we always recommend consulting with one to ensure the document complies with the legislative requirements of a representation agreement.

More information about RA9 can be found on the Nidus website.

Path two: Planning for help today

This path is for people who are later in the dementia journey, when capability to understand is in question at the time of making the planning documents and they no longer meet the threshold for legal capacity.

While caregiver Greta is on the “planning for the future” path, her father has been living with dementia for several years and can no longer understand the nature and consequences of the planning documents. Greta’s father would be on the path of "planning for help today”.

In B.C., the choices at this point are limited to a Representation Agreement Section 7 (RA7) or Committeeship.

Representation Agreement Section 7 (RA7)

The Representation Agreement Section 7 (RA7) is a legal document that allows an adult whose mental capability is in question to give authority to a person they trust. The RA7 grants four areas of authority that include:

- Major and minor health care: Making decisions related to medications, tests, dental care and minor surgery.

- Personal care: Deciding on living arrangements, making requests for a particular diet or therapeutic activities, like painting, light fitness exercises and guided walks..

- Legal affairs: While significantly more limited than what is covered through a full Enduring Power of Attorney, the RA7 can enable the representative to obtain basic legal services or settle an insurance claim. The representative with a RA7 cannot sell real estate.

- Routine management of financial affairs: Managing tasks like banking, applying for and managing government benefits, completing and managing income tax assessments, managing investments, or redirecting mail. It does not include, for example, obtaining a credit card or line of credit for the person.

The RA7 does not require notarization or a legal professional, although consulting with a lawyer or notary is highly recommended to ensure the document complies with the legislative requirements of a representation agreement.

More information about RA7 can be found on the Nidus website.

Committeeship

Committeeship is a court order from a judge – for example, an order from the Supreme Court of British Columbia – that gives another person the ability to manage some aspects of a person's affairs while they are still alive. Committeeships are only issued after someone has lost the ability to manage their own affairs. This is a serious legal step and is intended to be used as a last resort. Preparing for an Enduring Power of Attorney and Representation Agreement in advance is highly encouraged to avoid the need for committeeship. Committeeship can be a complicated process, so please consult your lawyer to learn more about the details involved in this court order.

To learn more about personal planning, watch our webinar here:

Tips for making an advance care plan

An advance care plan is a written summary outlining your wishes or instructions for future medical care, in case you become incapable of making decisions for yourself. This document helps your substitute decision maker (the person making the decisions on your behalf, such as a family member) understand what your wishes would be when a health-care decision is required.

The process of creating your advance care plan has three steps: Think, talk, plan.

- THINK about what matters most to you – your values and beliefs and about who might act on your behalf if you are not able to speak for yourself.

- TALK with the people you trust. This can include the people who are likely to make decisions on your behalf, for example, your family, close friends, your representative and your health-care providers.

- PLAN by writing down what is most important to you and capturing the contact information for potential decision makers, representatives and anyone with powers of attorney.

To learn more, watch a webinar co-hosted by the BC Centre for Palliative Care:

Discussing the kind of long-term care we want or whether we want to be given CPR and resuscitated is not always easy; our age, experiences and background all play a role in how comfortable we are. Nonetheless, these discussions are crucial, especially if you are living with dementia.

The First Link® Dementia Helpline is a useful resource for getting started with planning for the future and discussing the challenges that can arise during the process. Keep in mind that the information provided through the First Link® Dementia Helpline is only intended to help guide you on how to get started with personal planning and does not take the place of advice from qualified legal and financial professionals.

The First Link® Dementia Helpline is available from Monday to Friday:

⦁ English: 1-800-936-6033 (9 a.m. to 8 p.m.)

⦁ Cantonese and Mandarin: 1-833-674-5007 (9 a.m. to 4 p.m.)

⦁ Punjabi, Hindi and Urdu: 1-833-674-5003 (9 a.m. to 4 p.m.)

Helpful resources about personal planning as part of the dementia journey

- Dementia and Decision-Making Project - British Columbia Law Institute (webpage)

- Personal planning along the dementia journey (PDF – checklist)

- Annual guide to income tax and benefits (webpage – summary of tax benefits/credits)

- Planning for your future (webpage)

- Nidus.ca (Personal Planning Resource Centre and Registry)

- People's Law School provides free legal education and information to help people in British Columbia resolve everyday legal matters.

- Planning for Your Future booklet, published by People’s Law School

- Public Guardian and Trustee (PGT) provides services to adults who may need help managing their affairs, and to their family members, legal representatives, the courts and the general public. For example, support with reports of elder abuse, financial or personal decision making, review and monitoring of committees.

Videos:

- Advanced care planning introduction – my wishes, my care webinar, co-hosted with the BC Centre for Palliative Care

- Financial Confidence Workshop webinar, presented by IG Wealth Management

- Personal planning along the dementia journey webinar presented by the Alzheimer Society of B.C.

- Accessing services webinar playlist presented by the Alzheimer Society of B.C.

- The power of effective personal planning webinar, presented by Emily L. Clough, Managing Partner, TEP, Clark Wilson LLP

- An introduction to personal planning and representation agreements in BC video from Nidus